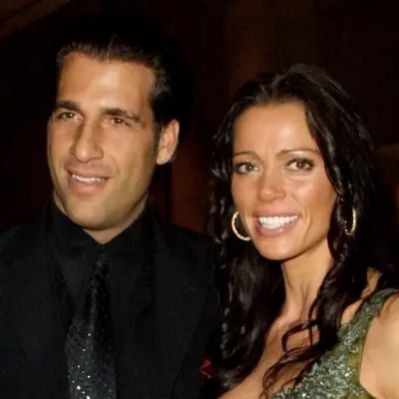

What Is Amanda Staveley’s Net Worth?

Amanda Staveley, a prominent British financier and businesswoman, has an estimated net worth of $170 million [1]. This valuation reflects her successful career in facilitating major investment deals, primarily through her firm, PCP Capital Partners [1]. Staveley’s financial acumen and strategic partnerships have enabled her to broker significant transactions involving Middle Eastern investors, contributing substantially to her wealth [1].

Career Highlights and Key Deals

Staveley’s career began with an entrepreneurial venture in 1996, when she acquired the Bottisham restaurant Stocks using a loan of £180,000 [1]. This initial foray into the business world provided her with valuable connections, particularly within the horse racing community in Newmarket, where she interacted with members of the Al Maktoum family of Dubai, owners of the Godolphin stables [1]. Staveley’s early business ventures also led her to become an angel investor in dot-com and biotech firms during the late 1990s [1]. In 2000, she transitioned from the restaurant business to establishing the conference center Q.ton in Cambridge Science Park, later selling a 49% stake to EuroTelecom [1]. However, the collapse of the dot-com bubble led to EuroTelecom’s failure, and Staveley eventually repurchased the stake, though she was unable to restore Q.ton to its initial success [1].

The establishment of PCP Capital Partners in 2008 marked a turning point in Staveley’s career [1]. Based in London, the firm operates through offshore private equity affiliates, serving as a conduit for Middle Eastern investors [1]. One of Staveley’s early high-profile deals involved facilitating Sheikh Mansour’s £210 million acquisition of the football club Manchester City through the Abu Dhabi United Group [1]. Simultaneously, she was involved in negotiations for Sheikh Mohammed bin Rashid Al Maktoum’s potential purchase of a 49% stake in Liverpool, though this deal ultimately did not materialize [1]. A significant achievement came in 2008 when Staveley played a pivotal role in securing a £7.3 billion investment in Barclays by the ruling families of Abu Dhabi and Qatar [1]. Her involvement in this transaction earned her £30 million [1].

In late 2021, Staveley successfully purchased Newcastle United with the Reuben Brothers and the Public Investment Fund for £300 million [1]. She became the club’s director alongside Jamie Reuben and Yasir bin Othman Al-Rumayyan [1]. Staveley has been involved in numerous other deals with Middle Eastern investors [1]. In 2008, she fronted a bid by the Qatar Investment Authority to purchase the facilities management company Trillium, although the bid failed [1]. Staveley was also involved in a failed attempt to help finance the $13.5 billion sale of Barclays Global Investors to the firm BlackRock [1]. She had more success in 2010 when she advised the Qatari property investment company Barwa in its acquisition of the Park House site in London [1]. A couple of years later, Staveley helped one of her Middle Eastern private equity groups purchase the Arundel Great Court site on the north bank of the Thames in London [1].

Details on Newcastle United Acquisition

Amanda Staveley’s pursuit of Newcastle United involved multiple attempts before ultimately succeeding in 2021 [1]. Initially, her bid to purchase the football club in late 2017 was unsuccessful [1]. She made another attempt in 2020, collaborating with the Saudi Arabian government’s sovereign wealth fund, the Public Investment Fund, but this too failed to materialize [1]. It was only in late 2021 that Staveley, in partnership with the Reuben Brothers and the Public Investment Fund, finalized the acquisition of Newcastle United for £300 million [1]. Following the successful takeover, Staveley assumed the role of director at the club, alongside Jamie Reuben and Yasir bin Othman Al-Rumayyan [1].

The acquisition of Newcastle United was met with considerable scrutiny and criticism, with many denouncing it as “sportswashing” [1]. In response to these concerns, Staveley defended the acquisition, asserting that the Public Investment Fund, which spearheaded the takeover, operates as a separate entity from the Saudi Arabian government [1]. The successful purchase of Newcastle United marked a significant milestone in Amanda Staveley’s career, further solidifying her position as a key figure in facilitating major investment deals [1]. Her ability to navigate complex negotiations and secure substantial financial backing from Middle Eastern investors played a crucial role in completing the transaction [1].

Net Worth Ranker

Net Worth Ranker